Fine Art & Rare Assets

Investment Management

About Artory / Winston

Artory/Winston is a private art and collectibles asset manager established as a joint venture between Artory and Winston Art Group.

Our mission is to create credible investment opportunities by sourcing the finest artworks and collectibles with high potential to grow in value and generate strong returns for our investors. To create these unique offerings, Artory/Winston adheres to an institutional-quality investment process by leveraging the data and technology of Artory as well as the domain expertise and services of Winston Art Group.

Sharing office space on 56th Street in Manhattan, the Artory and Winston teams work side-by-side to build innovative asset management solutions for trusted real-world assets.

Expert-Led & Data-Driven

Our team has a decades-long track record of sourcing artworks for museums, institutions, and UHNW clients–including some of the largest private and public art transactions over the past 20+ years. Sourcing for our offerings is led by Winston Art Group, which has appraised over $100 billion of art and collectibles since its inception in 2010 and advises on transactions for 30% of the largest art collectors in the world. Winston’s expertise is supplemented by Artory’s industry-leading dataset of over 44 million historical transactions to inform sourcing, valuation, and market indices.

Asset Diligence Secured on the Blockchain

To ensure a robust, compliant investment process, Winston Art Group conducts due diligence on each artwork prior to investment, based on a proven methodology of over 50 factors. This wealth of information contributes to the potential resale value of each artwork and is captured through Artory’s secure and audit-ready tokenization technology. Our tokenized assets are kept current with regular appraisals and market data, which helps Artory/Winston to identify the ideal opportunities to sell and deliver returns to our investors.

Our Investment Philosophy

Art and Collectibles Investing Requires Significant Domain Expertise

Fine art and rare assets investment requires ongoing diligence, trusted market expertise, and proactive management: services not available to the typical investor. To overcome these barriers to entry, it takes experienced partners in the market to understand which assets have the highest potential to excel.

Capitalization Through Active Management

The valuation of fine art collectibles is complex and does not follow the economic conventions of supply and demand. This landscape, while influenced by factors like trend-driven demand and scarcity, gives an edge to active portfolio managers with data-driven valuation insights and access to acquire certain assets.

Data Science Underpins Risk Management and Value Analysis

Data science applied to art and collectibles investing unearths patterns, correlations, price trends, artist trajectories, buyer behavior, and other market dynamics. Predictive analytics enable data-driven acquisition decisions, helping identify artists whose artworks are expected to significantly appreciate in value.

Blockchain Technology Safeguards Value & Due Diligence

Blockchain registries provide a tamper-proof, decentralized record of an artwork’s journey, highlighting endorsements from key luminaries and major showcases and exhibitions. With the entire transaction history of an artwork recorded on the blockchain, investors can have greater confidence in the legitimacy of acquisitions.

Investment Opportunities at a Glance

Artory/Winston engages trusted, reliable partners to ensure transparency—including a best-in-class fund administrator, auditors, and independent appraisers.

Diversified Artwork Portfolio

Accredited investors can participate in the Artory/Winston Art Fund, a closed-end fund leveraging the data and technology of Artory and the domain expertise and services of Winston Art Group.

Artory/Winston leverages their team’s data and valuation expertise to identify artworks and artists with the highest potential to appreciate. The team’s vast industry relationships allow us to source off-market artworks and access unique upside in negotiations for both acquisition and disposal.

Explore and InvestDiversified Wine & Whisky Portfolio

Accredited investors can participate in the Cask100 Wine & Whisky Fund, a closed-end fund leveraging the data and technology of Artory and the domain expertise and services of Winston Art Group.

Cask100 is a diversified portfolio of fine and rare wine and whisky from a range of producers, vintages and regions, allowing investors to access the potential advantages and returns of the wine and whisky market.

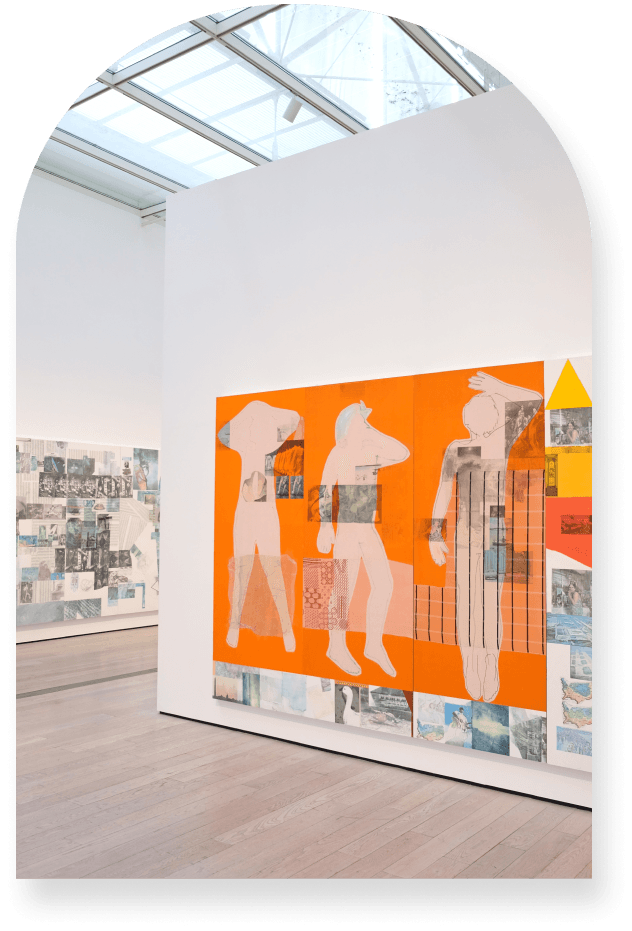

We have extensive experience, broad access to artworks, and a proven track record.*

Flags 1 (1973) | Jasper Johns

Sold at auction on behalf of Winston Art Group’s private client

Sold on behalf of a private client in April 2016 for $1,685,000

(sale price includes buyer’s premium)

Highest price paid for any printed Jasper Johns piece at the time.

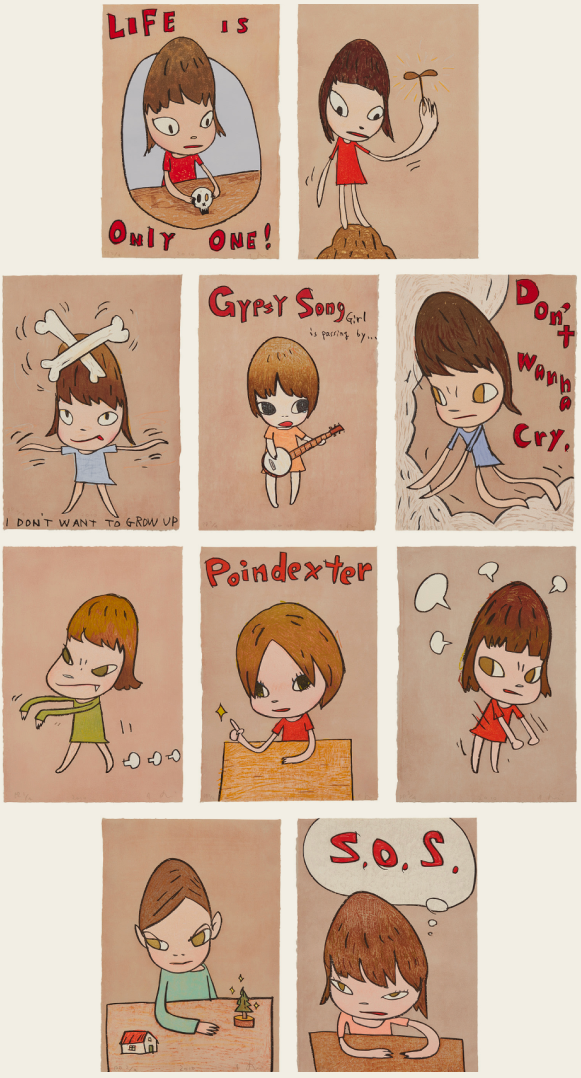

Untitled (M.&S. E-2010-003-E-2010-012) (2010) | Yoshitomo Nara

Purchased on behalf of a private client by Winston Art Group in 2012 on the primary market

Sold on behalf of a private client in April 2022 for $504,000

(sale price includes buyer’s premium)

Sold for over eight times the original purchase price.

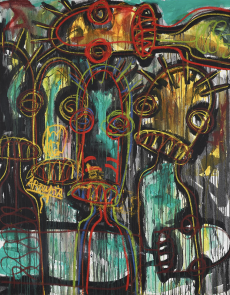

Abidjan Street Kids II (2015) | Aboudia

Purchased on behalf of a private client by Winston Art Group in 2019

Sold on behalf of a private client in May 2022 for $201,600

(sale price including buyer’s premium)

Sold for over eight times the purchase price.

The Riders II (2012) | Maria Berrio

Purchased on behalf of a private client by Winston Art Group in 2019

Sold on behalf of a private client in June 2022 for $983,706

(sale price including buyer’s premium)

Sold for over 75 times the original purchase price.

We are trusted partners in creating

investment strategies for curated artworks.

Artory is the only platform in the world that provides reliable fine art information on the blockchain from credible partners. Artory collaborates with respected institutions, giving them the tools needed to create digital registrations that are immutable records of provenance and expert due diligence on works of art and collectibles.

Winston Art Group brings the highest level of expertise to each art investment offering through longstanding relationships with some of the most prestigious galleries, art institutions, auction houses, and art collectors around the world. Our far-reaching network and unparalleled standards of due diligence position the company ideally to assess ever-evolving trends in art valuation, acquisition, and trading in the art market.

Together, Artory/Winston has exceptional access to the primary and secondary art markets, in addition to private collections around the world. As part of the joint venture, Winston Art Group sources artworks for the offerings with the same high standards of practice that it brings to every artwork it inspects, purchases or sells for its clients. Findings are captured by Artory’s digital tools which create a Due Diligence Certificate to be relied upon in artwork investment transactions for decades to come.